Boston? Framingham? Malden? Quincy? No matter where you reside, flood insurance might be a viable option to protect you and your property.

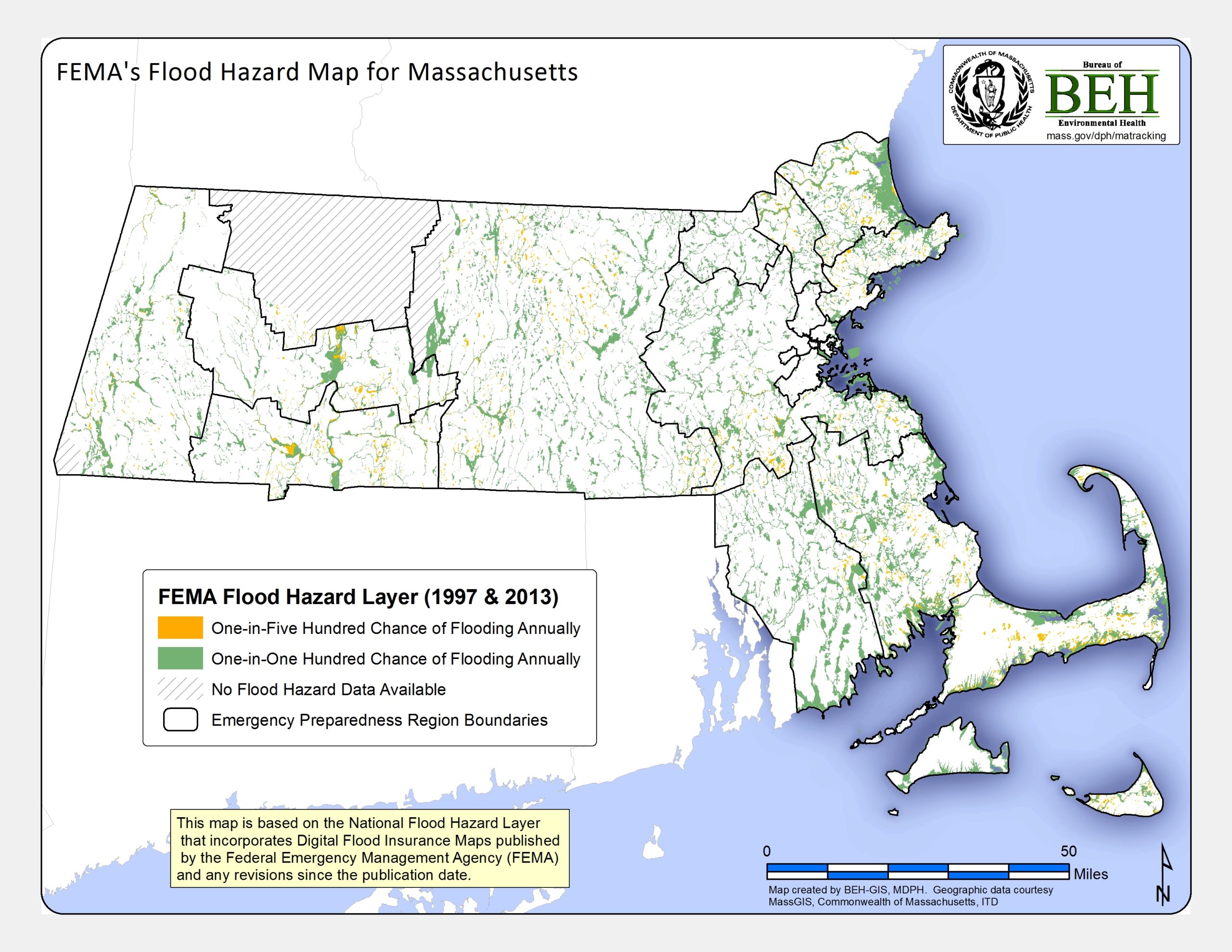

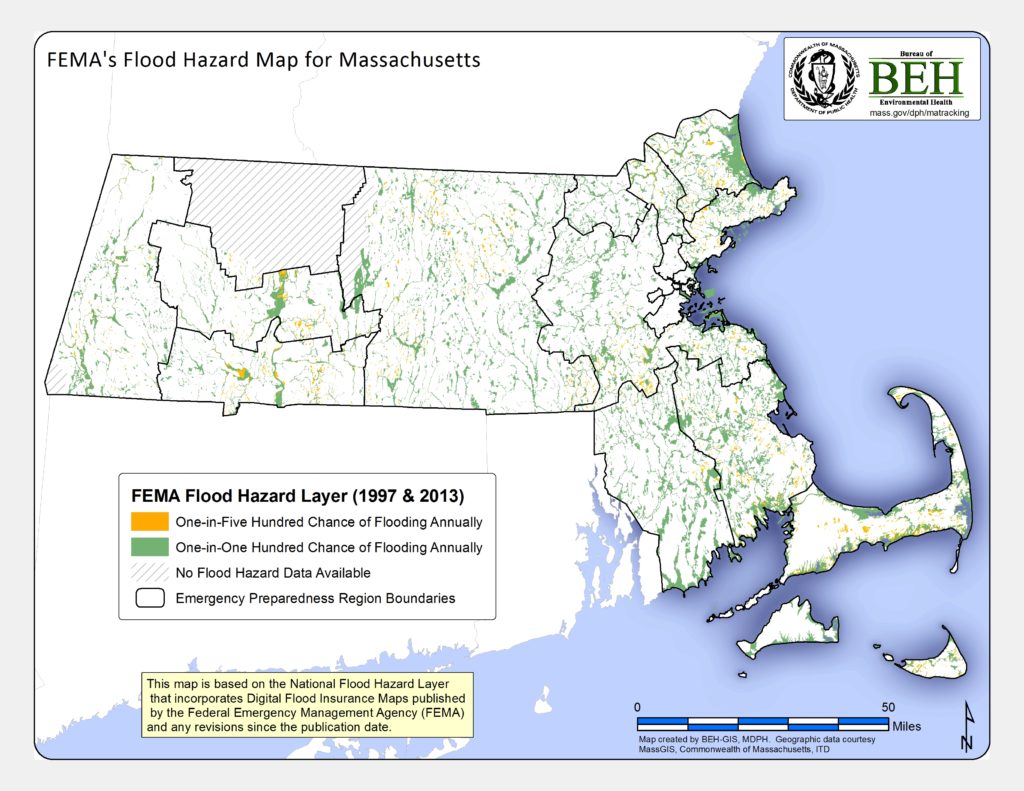

In addition to being aware of the top things you should know about flood insurance and what flood insurance covers, another important factor to consider is whether or not you live in a flood zone. To learn more about this, you can type in your address on the website for FEMA’s Flood Map Service Center. However, these maps can sometimes get a bit confusing, so we’re here to break it down for you.

First off, it’s important to note that flood zone maps are frequently updated, so it might be beneficial to check back every so often if you do decide against purchasing flood insurance. Furthermore, it’s possible that only part of your property is in a high-risk zone, or that your property sits on two different classifications of zones.

Low-Risk Zones

FEMA has more than ten different classifications of flood zones, ranging from low-risk zones, such as X or D zones, to higher risk zones, such as V or A zones, where flood insurance is mandatory. However, in low-risk areas like X-zones or D-zones, an insurance policy isn’t a required purchase. The difference between these two zones is that X-zones are minimal-risk, while D-zones have yet to be studied and may be subject to flooding.

High-Risk Zones

When it comes to high-risk areas, zone Z typically includes beachfront properties, while zone A includes properties near other bodies of water, like lakes or rivers. Zone A regions can also have different names, such as AE, AH, and AR since these areas are named differently based on the way in which they might be flooded. Regardless, they’re still a part of the high-risk A-zone.

Other Features

Aside from zone distinctions, the FEMA flood map has a key beneath the map that identifies the meaning behind different colors and graphics that may be seen on the map. These include different color shadings for various zones, graphics depicting levees or floodwalls, and more.

Although flood maps can sometimes be difficult to decode, this guide should make the process a bit simpler. Still, have questions? Reach out to a Breezy Seguros agent today for assistance!