Learn finance and invest in your furture.

Getting your finances on a healthy path can be difficult, but the Breezy Seguros team is here to help. Finance and insurance are industries intertwined; our goal is to equip people with the tools and resources for them to achieve financial independence and well-being. Below I describe a few good routines to pick up to enhance your financial literacy and money management skills.

Tracking your spending and expenses.

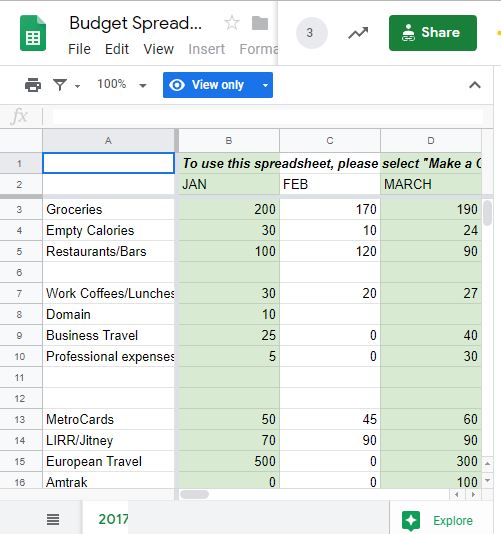

A good starting place to improve your finances is by tracking all transactions, expenses and cash flow. The Business Insider published an article by Libby Kane who very kindly provided a customizable budgeting template to record and keep track of your earnings and expenses.

It’s a Google Sheet that is for you to download and customize yourself. Start using it today, it’s a great tool to track your money habits. There is column so you can keep tabs on your monthly and yearly transactions as well. Click here to read Kane’s full article or click here to download a copy of the Budget Spreadsheet for yourself. And also take advantage of using this cash flow calculator tool to analyze your current cash flow.

Listen daily to topics on finance podcasts.

For me, I learn best by listening to experts discuss subjects such as debt and equity finance, personal and private banking, wealth management, and amongst others. The FT Alphaville is a podcast I enjoy listening to and one of their episodes titled, ‘The wisdom of finance’ that I thought was insightful.

The host who’s a Harvard business and law professor, Mihir Desai and Matt Klein, they have an interesting discussion about how finance and insurance are closely related because of risk management. Insurance serves the purpose of reducing one’s party exposure to the effects of particular risks. These risks are delegated by policies for the insured in return for paying a premium.

Sticking to your budgeting plan.

Learning how to be financially responsible doesn’t have to be difficult, you just need to have a plan in place. Improving your money management will help you reach your goal of financial freedom. Likewise, Mint is a great app that will not only allow you to track your bank transaction, but also your credit score, bills, and investments.

They are owned by Intuit, Inc., a tech and finance company that offers good resources for when tax season rolls around again. In addition, the Mint app has a feature for you to compare life and auto quotes for insurance companies.

Unlike the big insurance companies, Breezy Seguros is a local and independent agency. We provide the same services and plan, but with more options and carriers. Submit a free price quote today and see how much you’ll save on your premiums by switching over to us. Breezy Seguros has a wide selection of policy options from personal to commercial plans. Speak with a local Breezy Seguros agent today to see how you can save by coupling your auto and home policy.

Want to save on your monthly plan? Call Breezy Seguros today and save!

Drop us a line today for a price quote now. Our Breezy Seguros agent will compare rates and give you the lowest price with the best coverage.